We would like to thank all of those who voted for us as “2017 Best Accounting Services”! We would not be the well-established business we are today if it were not for our faithful clients. We thank you and hope to be providing our services for many years to come.

Refund Advance!

Clients may be eligible for a “refund advance” for up to $1,200 when we file your tax return!

If you are interested please call our office during working hours.

Monday – Saturday, 8:30 a.m. – 7:00 p.m.

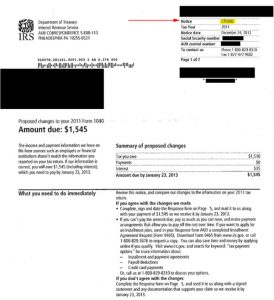

Warning: Fraudulent Notices

The IRS has received numerous reports of scammers sending a fraudulent version of a notice (labeled CP2000) for tax year 2015. The issue has been reported to the Treasury Inspector General for Tax Administration for investigation.

Generally, this scam may arrive by email as an attachment, but could also be received by mail. It has many signs of being a fake:

• The CP2000 notices appear to be issued from an Austin, Texas, address;

• The letter says the issue is related to the Affordable Care Act and requests information regarding 2014 coverage;

• The payment voucher lists the letter number as 105C;

• Requests checks made out to I.R.S. and sent to the “Austin Processing Center” at a post office box.

An authentic CP2000 notice/letter is commonly mailed to taxpayers through the United States Postal Service. It is never sent as part of an email to taxpayers. Unlike the fake, the authentic notice provides extensive instructions to taxpayers about what to do if they agree or disagree that additional tax is owed. A real notice requests that checks be made out to “United States Treasury.”

If you receive this or any other suspicious contact from someone claiming to be from the IRS, please do not do anything before contacting our office.

Sandra Crider

August 29, 2016

We have been notified of a NEW TELEPHONE SCAM ALERT: The latest telephone scam will show on your Caller ID as the number 800-829-1040, which leads taxpayers to believe the call is from the IRS. The caller may or may not leave a message if you don’t answer. They may identify themselves as an “IRS Agent” and give you their “badge number”. This is still a fraudulent call. No one from the IRS will ever call you. They only communicate by mail.

If you do answer, do NOT give this caller your social security number, banking account number or any other information! They will claim you owe a substantial amount of money to the IRS and threaten you with jail time when you do not give them your information. Just hang up.